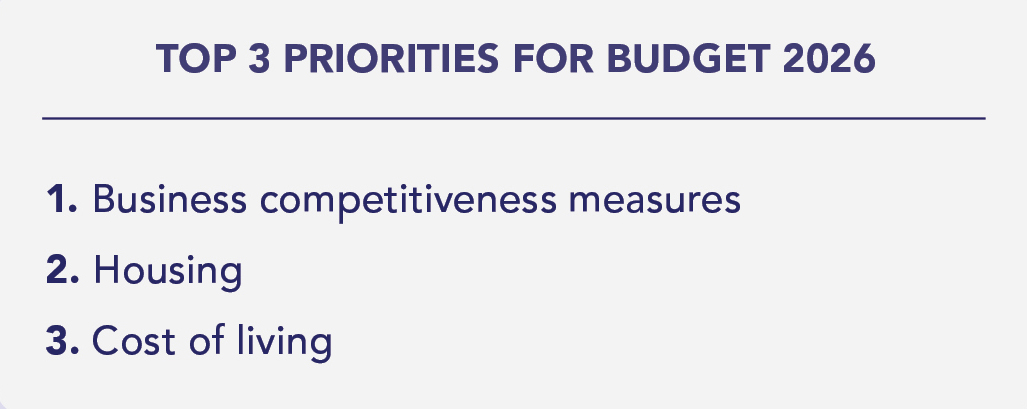

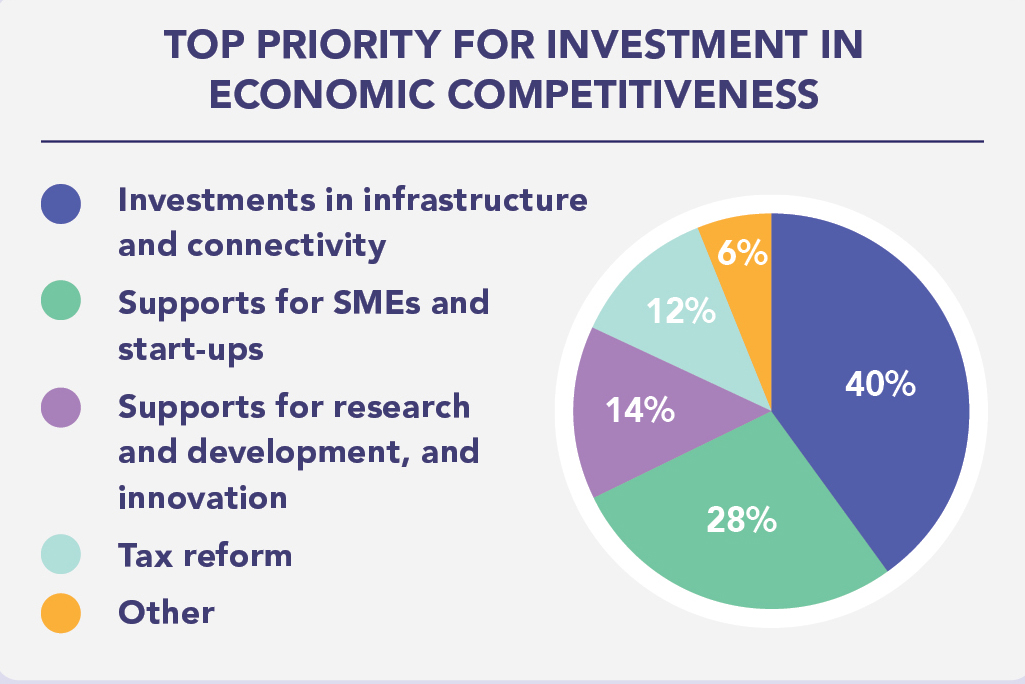

As Budget 2026 approaches, measures to strengthen competitiveness are the top priority for Cork Chamber members. This includes investments in infrastructure, supports for SMEs and start-ups, and R&D supports.

Investments in housing and measures targeting the cost of living are also critical for Cork’s business community.

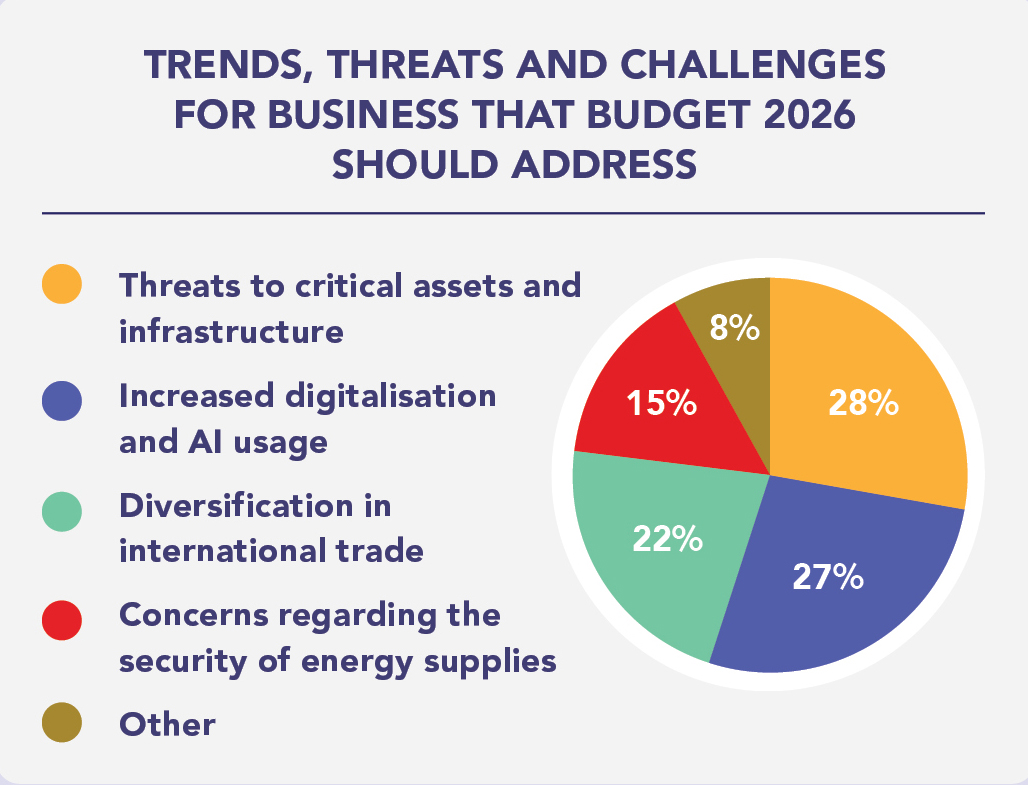

Cork Chamber members emphasised the importance of Budget 2026 addressing some of the key trends, threats and challenges for business at present.

Threats to critical infrastructure and the increased use of AI emerged as the two most important issues for Budget 2026 to address.

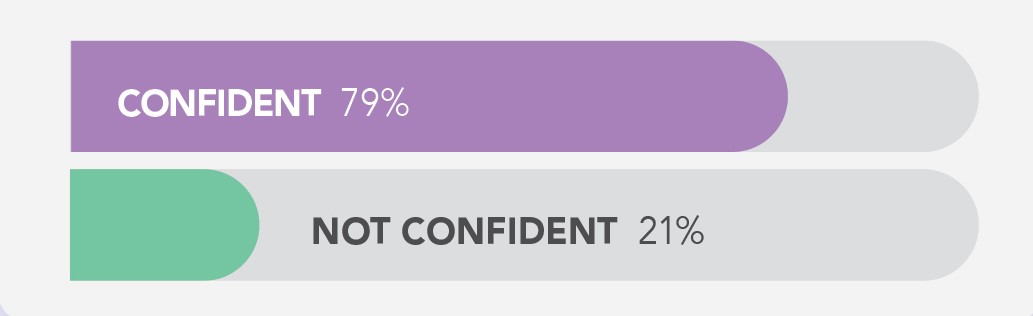

79% of respondents expressed confidence in the Irish economy in Q2 2025, a slight increase on Q1 of this year.

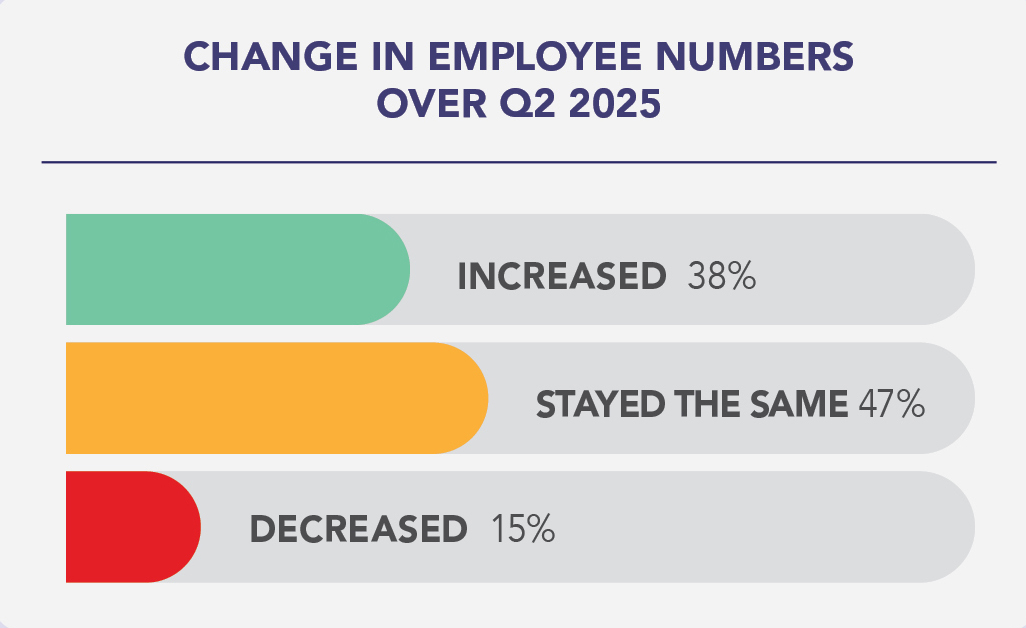

In Q2 2025, 38% of respondents reported an increase in employee numbers, while 47% maintained the same number of employees.

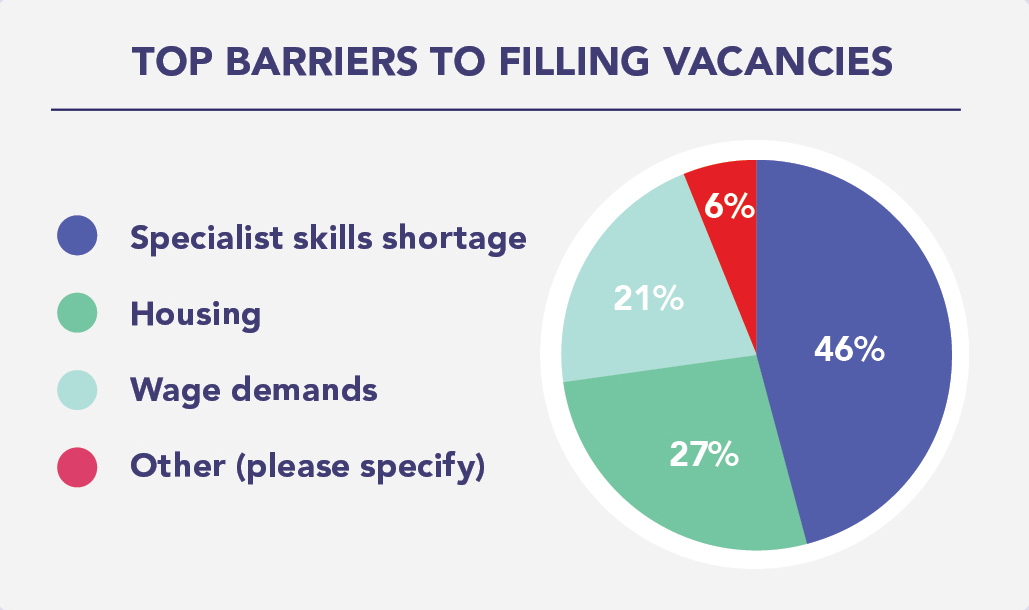

Of the 43% of respondents with vacancies advertised at present, 31% reported difficulties with filling these roles (with roles remaining vacant for 3 months or more). Specialist skills shortages emerged as the top barrier to filling vacancies.

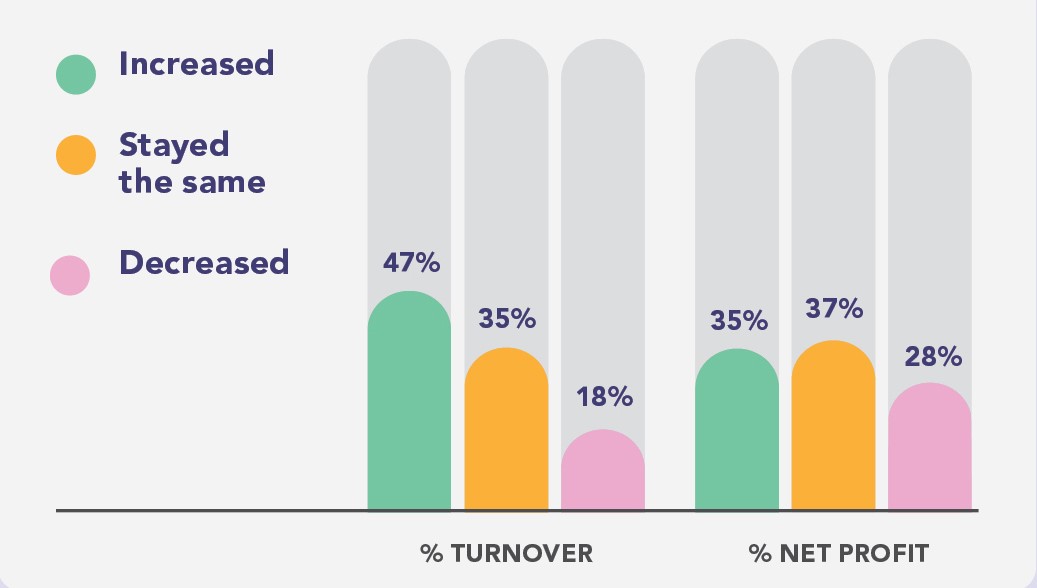

The number of respondents reporting an increase in turnover remained consistent with Q1 at 47%, as did those reporting an increase in net profit.

43% of respondents predict an increase in turnover in the next quarter, while the majority – 51% – expect turnover to stay the same in Q3.